When you start self-employment, you do not get your first tax bill for a while, so you need to think about how much money to set aside now.

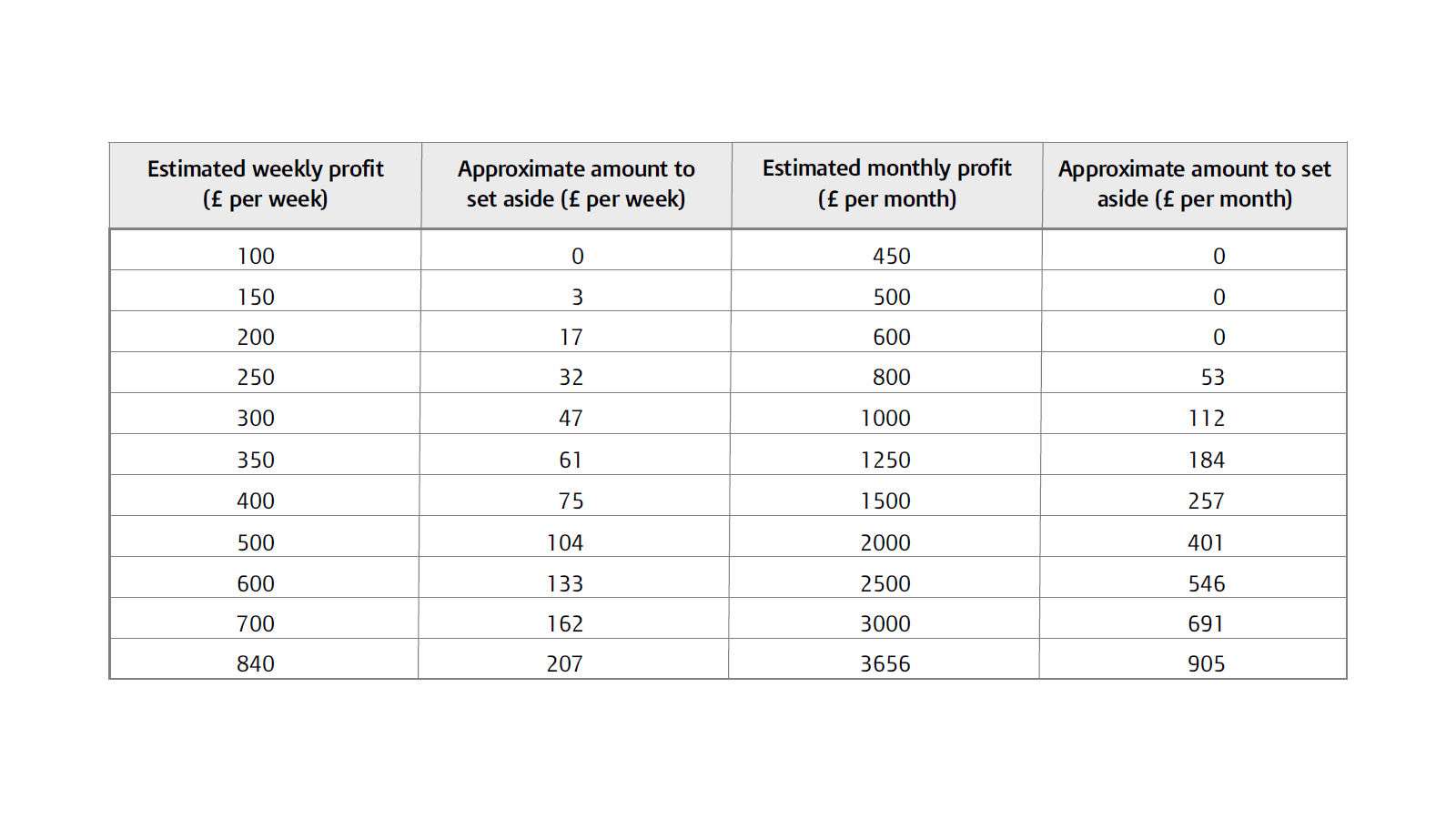

The table below can help you to do this. It shows you how much money you might need to set aside to meet your tax and Class 4 National Insurance contributions (NICs) bill. It doesn’t include Class 2 National Insurance contributions which you will need to pay separately – this is around £2.50 a week for 2011–12.

The information below uses estimated weekly/monthly profit figures and is based on a self employed individual, who has no other income which should be taxed and is entitled to a basic Personal Allowance. Profit is your income less expenses.

The exact amount of tax and/or Class 4 National Insurance contributions due and payable can only be worked out once you have completed your Self Assessment tax return.

The table below will help you work out the approximate Income Tax/Class 4 NICs to set aside each week/month.